HOW TO VALUE YOUR COMPANY?

Business valuation firms use a variety of techniques to value companies including the Discounted Cash Flow Model, Public Market Comparisons and various Asset Value methods. While these valuation methods are technically accurate and provide the owner with valuable information for the purpose of tax planning, estate planning and divorce settlements, they do not necessarily reflect the true market value of the company when it is offered for sale.

In the world of mergers & acquisitions of profitable mid-sized companies, there is one method that is used more frequently than any other when valuing a business for a potential acquisition. This method is known as the EBITDA Multiple calculation.

Why should you care how buyers value businesses? By understanding the fundamentals behind business valuation, you have the ability to focus on and improve the specific financial metrics that buyers equate with value, and by doing so you will be able to increase the purchase price of your company when it is sold. Also, you will be able to better prepare for and plan your exit strategy since you will know what financial goals your company must reach in order to obtain the price that you desire. This blog briefly discusses the processes that most buyers use to determine the value of an acquisition target.

WHAT IS EBITDA?

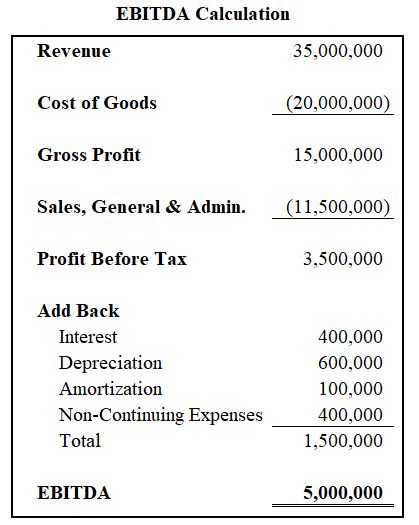

Buyers generally form the basis for the price they offer by calculating and analyzing a financial measurement called EBITDA (Earnings Before Interest Taxes Depreciation & Amortization). To calculate EBITDA, start with the pre-tax net income of the business and add back interest expense, depreciation and amortization. The company’s EBITDA is then adjusted for unusual one-time expenses or items that will not continue under new ownership, such as non-business related travel, auto expenses, excess owner salaries, excess rent, etc. For a simple calculation see the example below.

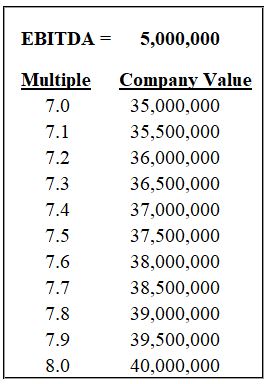

After the company’s EBITDA is calculated, it is multiplied by a number (the “multiple”) to arrive at a value. The multiple applied to a particular business will vary based on several factors, but for profitable mid-sized companies, multiples generally range from 5 to 8 times EBITDA. High margin, niche businesses with a strong track record of revenue growth and profitability will command high multiples, while low-value-added, commodity businesses will tend to garner lower multiples. As a general rule, larger companies receive higher multiples than smaller companies, and companies that operate in capital intensive industries tend to sell for lower multiples due to the continued capital investment necessary to maintain the business.

IS EBITDA THE BEST METHOD FOR VALUING COMPANIES ?

EBITDA is used to analyze a company’s operating profitability by excluding the non-operating expenses (interest and taxes) and non-cash charges (depreciation and amortization). It is a good way to compare the performance of companies within an industry to identify companies whose operations are more efficient. Also, since many acquisitions involve some type of financing, a company’s EBITDA gives the buyer an indication of the company’s ability to service the interest and debt payments used to acquire it. Although EBITDA is sometimes used interchangeably with cash flow, it does not take into consideration the cash required for increasing working capital, continued capital expenditures or debt payments. There is, therefore, some controversy in the financial community as to the usefulness of EBITDA as a measurement tool of a company’s performance. Regardless of the pros and cons of using EBITDA as a financial yardstick, it is by far the most common method used by buyers to value acquisition targets, therefore, it is important for you to know what it is and how to calculate it.

WHICH MULTIPLE SHOULD BE USED FOR YOUR BUSINESS?

If you are operating in an industry where companies typically sell for 6 to 7 times EBITDA, you should be comfortable with this general valuation range before marketing your company. If the last 10 transactions in your industry have sold for 6 times EBITDA, it is unrealistic to believe that a sophisticated buyer would value your business at 10 times EBITDA, unless there is something truly unique about your business. It would, however, be realistic to believe that your business could sell for 7 or 7.5 times EBITDA if you take the necessary steps to prepare your business and if you manage the sales process properly.

WHAT SHOULD YOU DO TO PREPARE YOUR BUSINESS FOR SALE?

Focus on the fundamentals: diversify your customer base, analyze your products and pursue higher margin business, report all revenue, eliminate non-business-related expenses, clean up your financial statements, and resolve any pending litigation. Perhaps the most important and most overlooked way to increase the value of a company is to hire or train competent management to replace yourself if you plan to leave following the sale.

Buyers are less likely to pay a premium multiple for a company whose success is completely tied to the owner. They will pay a premium multiple, however, for a company with a management organization and infrastructure in place that will continue after the company is purchased. The importance of management continuity when selling a business cannot be overstated. If the existence of your company is dependent on you showing up to work every day, you should seriously consider bringing in new talent or promoting your top management in order to minimize your importance to the organization.

BUYERS ARE SOPHISTICATED

It is important for sellers to realize that buyers of mid-sized companies are sophisticated business people. They will go through a rigorous evaluation of a potential acquisition candidate before making an offer to purchase it. If the seller’s expectations are far outside the range of reasonable EBITDA multiples paid in the industry, buyers will pursue another avenue to enter the market, such as acquiring a competing company. The objective is to convince the buyer that your company deserves the top multiple paid in the industry. To achieve this, it is imperative that you clearly communicate the value of your company to potential buyers and show the buyers why the acquisition makes financial sense for them. As shown in the example above, increasing the multiple from 7.0 to 8.0 times EBITDA results in a $5.0 million purchase price increase. Having a trusted and experienced advisor on your side to analyze your company, prepare the offering materials, negotiate with buyers, and create competition is the best way to achieve the highest possible EBITDA multiple for your company.